Trend Following - What Decades of Research Reveal

- Fabio Capela

- Finance , Investing strategies , Portfolio management , Risk management , Trend following , Systematic trading , Market momentum , Volatility targeting , Machine learning , Reinforcement learning , Alternative data

- February 11, 2025

Table of Contents

Trend following has long been a conerstone strategy for traders and investors. By systematically riding market momentum, trend following strategies have historically delivered strong risk-adjusted returns across various asset classes. But how does the strategy hold up in different environments, and what does academic research say about its efficacy? Let’s explore the key insights from a wealth of scientific literature on trend following.

1. The Long-Term Evidence: Does Trend Following Work?

A study titled “A Century of Evidence on Trend-Following Investing” by Hurst, Ooi, and Pedersen (2017) provides one of the most compellinng cases for trend-following. By analyzing over 137 years of data across equities, bonds, commodities, and currencies, the researchers show that trend following has consistently produced positive returns, The strategy thrives particularly in periods of market turbulence, making it a powerful diversifier in multi-asset portfolios.

Similarly, “Trend Following: A Persistent Market Anomaly” (2015) confirms that the profitability of trend following strategies is not a short-term market inefficiency, but a long-lasting phenomenon. The study attributes the strategy’s sucess to investors’ behavioral biases, such as herding and underreaction to new information.

Explore more about this research

Trend Following vs Buy-and-Hold

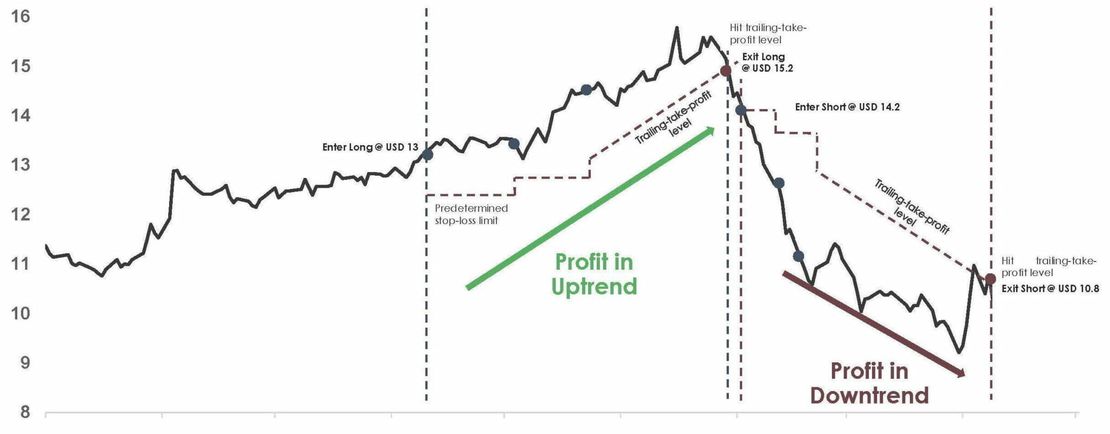

While trend following strategies offer significant benefits, how do they compare with tradiational buy-and-hold investing? One key advantage is that trend following strategies tend to reduce drawdowns. During prolonged bear markets, trend following often shifts to cash or short positions, whereas buy-and-hold investors may suffer heavy losses. Additionally, trend following works across multiple asset classes, meaning it isn’t constrained by the performance of a single market, unlike buy-and-hold investors who might be overexposed to equities.

2. Trend Following’s Convexity: Why It Wins in Crises

One of the defining characteristics of trend following is its convex return profile. In “The Convexity of Trend Following” (2018), researchers demonstrate how trend following strategies tend to generate strong positive returns during market crises, providing a hedge against equity market drawdowns.Unlike traditional asset allocation strategies, trend following adapts dynamically to price movements, allowing it to capitalize on both uptrends and downtrends.

Check out the study on convexity

Historical Performance in Bear Markets

Trend following strategies have historically provided positive returns during major market downturns. For instance, during the 2008 financial crisis, trend following funds performed exceptionally well as they capitalized on the prolonged downtrend in equities and commodities. Similarly, during the COVID-19 market crash in early 2020, systematic trend following strategies quickly adapted and profited from significant price movement in bonds, equities, and currencies.

3. Enhancing Trend Following Strategies

Despite its success, traditional trend following strategies have weaknesses, such as whipsaws (false signals) and sensitivity to parameter choices. Research has explored ways to refine trend following models:

-

“A New Approach to Trend Following” (2023) discusses techniques to reduce noise and improve signal detection. Read more

-

“Trend Following, Stop Losses, and the Frequency of Trading” (2012) analyzes how stop-loss mechanisms and optimized trade frequency can improve risk-adjusted returns. Learn more

-

“Optimal Trend Following Portfolios” (2022) offers a framework for constructing optimal portfolios based on trend signals. Full paper here

The Role of Volatility in Trend Following

Volatility plays a crucial role in determining the effectiveness of trend following strategies. Many researchers advocate for volatility-adjusted trend following models that scale position sizes dynamically based on market volatility. By reducing exposure in highly volatile periods and increasing it when trends are stable, these models aim to maximize risk-adjusted returns.

4. Machine Learning Meets Trend Following

Recent advancements in artificial intelligence are reshaping the landscape of trend-following. Studies like “Few-Shot Learning Patterns in Financial Time-Series for Trend-Following Strategies” (2023) and “Beyond Trend Following: Deep Learning for Market Trend Prediction” (2024) highlight how machine learning models can adapt to market conditions more efficiently than traditional methods. These approaches use dynamic learning techniques to refine trend signals and potentially enhance profitability.

Discover how AI is revolutionizing trend following

Reinforcement Learning for Trend Following

One of the most exciting applications of AI in trend following is reinforcement learning. Instead of relying on static rule-based systems, reinforcement learning algorithms continuously adapt and optimize trading strategies in real-time. These systems learn from historical data and adjust position sizing and risk management dynamically, making them more resilient to market shifts.

5. The Future of Trend Following

As financial markets evolve, so do trend following strategies. The integration of altnerative data, improved execution algorithms, and machine learning driven enhancements are shaping the next generation of systematic trend following models. However, the fundamental principles - following price momentum and volatility targeting - remain at the core of successful trend following strategies.

Alternative Data in Trend Following

Alternative data sources, such as satellite imagery, social media sentiment, and macroeconomic indicators, are becoming increasingly valuable in trend following models. By incorporating non-traditional data, traders can enhance their trend capabilities and gain an informational edge over traditional models.

Key Takeaways:

- Trend following has been consistently profitable across asset classes for over a century.

- It provides a convex return profile, performing well in market crises.

- Research suggests that optimized trade frequency and machine learning can enhance performance.

- AI-powered models are improving trend following strategies by adapting more dynamically to market conditions.

- Alternative data sources and reinforcement learning are shaping the future of trend-following.

For traders and investors looking to harness the power of momentum, trend following remains one of the most robust and well-researched strategies in finance. The scientific literature overwhelmingly supports its effectiveness, making it a valuable too in any systematic trading arsenal.

Tags :

- Portfolio drawdowns

- Low drawdown investing

- Investment strategies

- Core satellite investing

- Risk management

- The simple portfolio

- Sharpe ratio

- Reducing volatility

- Trend following strategy

- Diversified portfolio

- Trend following

- Systematic trading

- Market momentum

- Volatility targeting

- Machine learning

- Reinforcement learning

- Alternative data