Strategies for Reducing Portfolio Drawdowns in 2024

- Fabio Capela

- Finance , Investing strategies , Portfolio management , Risk management

- January 4, 2024

Table of Contents

In 2024, investors are more conscious than ever of the impact of market downturns on their portfolios. With global economic uncertainty and volatile market dynamics,reducing drawdowns - the peak-to-trough declines portfolio value - has become a key focus. By employing the right strategies, investors can protect their wealth and reduce the anxiety associated with significant losses. Below, we explore several actionable strategies to reduce portfolio drawdowns, helping you maintain steadier returns over the long term.

1. Diversify Beyond Equities

While equities often offer attractive returns, they also come with considerable risk, especially in volatile periods. A diversified portfolio that includes bonds, commodities, and alternative assets can reduce overall drawdowns. Bonds, for instance, tend to perform well when equity markets struggle, acting as a hedge. Real estate, which tends to be less correlated with stocks, can also add stability.

Incorporating diverse assets is essential for creating a low drawdown portfolio. This approach helps balance the potential losses in any single sector or asset class, allowing for a smoother return profile.

2. Use Tactical Allocation and Rebalancing

Rebalancing is an often-overlooked technique for managing risk, but it’s crucial to maintaining an optimal allocation based on current market conditions. Tactical allocation takes this one step further, allowing investors to adjust their exposure to various assets dynamically. For example, if equities are projected to face headwinds, increasing exposure to cash or bonds could reduce volatility and minimize potential losses.

For those looking to manage their portfolio without the hassle, services like TheSimplePortfolio offer a simple allocation that automatically adjusts to maintain a high Sharpe ratio of 1.66, prioritizing reduced drawdowns and stable returns.

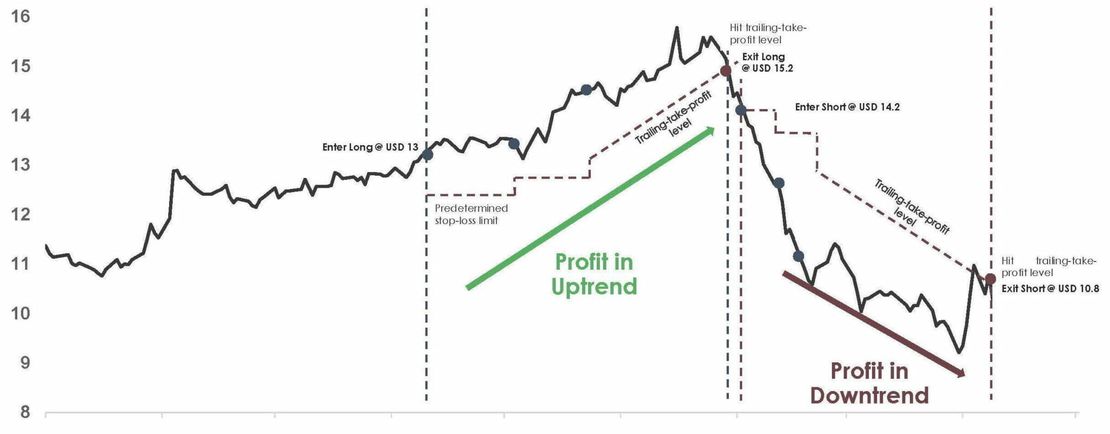

3. Implement a Trend-Following Strategy

Trend-following strategies help investors identify and follow market momentum, allowing them to avoid significan drawdowns in bearish conditions. By going long when markets are in an uptrend and reducing exposure or going short in downtrends, trend-following can significantly reduce the risk of large drawdowns.

Trend-following models are particularly effective when paired with statistical arbitrage and macroeconomic indicators, helping to further refine market timing decisions. This approach requires some technical expertise but can greatly enhance performance by cutting down exposure during negative market trends.

4. Embrace Risk Management Tools Like Stop-Loss Orders

For individual investors, stop-loss orders are an effective way to cap losses. A stop-loss order automatically sells an asset once it hits a specified price, limiting potential losses and helping investors stick to their risk tolerance. However, it’s essential to set these thresholds carefully, as premature selling can result in missing potential recoveries.

5. Focus on Quality Assets with Low Volatility

Choosing high-quality assets - typically, companies with strong financials and low debt - can help minimize drawdowns. These assets often exhibit lower volatility and can weather economic downturns better than speculative or high-growth stocks. Incorporating low-volatility ETFs or dividend-paying stocks can stabilize returns, helping to cushion your portfolio during downturns.

6. Implement a Core-Satellite Portfolio Strategy

A core-satellite approach offers the best of both worlds: stability and growth. In this strategy, the core portfolio consists of broad-market ETFs or equities that provide long-term growth and diversification, while the satellite portion includes higher-risk, higher-reward assets. This way, you retain the potential of a satellite strategy while keeping the bulk of your investments in stable, diversified holdings.

By using TheSimplePortfolio as part of your core, you gain access to a tried-and-tested allocation model with a strong Sharpe ratio, proven to outperform with minimized drawdowns.

7. Incorporate Hedging Strategies

Hedging can be an effective way to protect a portfolio from downside risk, especially during market downturns. Common hedging techniques include options strategies like buying put options, which gain value when the underlying asset declines. Investors can also use inverse ETFs that move in the opposite direction of major indexes, offering an easy way to hedge against a market decline.

Hedging can help reduce drawdowns by creating a buffer in periods of market stress. However, it’s crucial to remember that hedging can also reduce potential returns and increase costs, so using it selectively is often the best approach.

8. Monitor Macroeconomic Indicators for Early Warning Signs

Macroeconomic indicators such as inflation rates, interest rates, and unemployment figures can provide valuable insights into the health of the market and help investors anticipate potential downturns. By keeping an eye on these indicators, you can adjust your portfolio allocation to mitigate potential drawdowns.

For instance, if inflation is on the rise and central banks are tightening interest rates, it could signal trouble ahead for equities. Reducing exposure to high-growth stocks and increasing allocations to defensive sectors like utilities or consumer staples could help minimize drawdowns. TheSimplePortfolio leverages macroeconomic indicators in its allocation model, taking the guesswork out of portolio management and allowing investors to benefit from proactive adjustments based on market trends.

9. Emphasize a Long-Term Perspective

While reducing drawdowns is important, it’s also essential not to overreact to short-term volatility. A long-term perspective enables investors to ride out temporary downturns without making impulsive decisions that could harm their portfolios. Staying invested and allowing time for the portfolio to recover can often be more beneficial than constant adjustments, which may increase transaction costs and reduce gains.

Leverage TheSimplePortfolio for Simple, Effective Allocation

Many investors struggle to find the right allocation that balances risk and return. TheSimplePortfolio is a solution designed to meet this challenge, offering a simple, all-in-one portfolio allocation that reduces drawdowns without sacrificing returns. By combining multiple strategies, including trend-following, macro-based insights, and statistical arbitrage, it achieves a high Sharpe ratio, demonstrating its ability to manage risk effectively.

Using TheSimplePortfolio’s allocation can help you build a portfolio that keeps up with the market during good years and reduces losses during challenging periods. Plus, you gain access to a dashboard that tracks key performance metrics, such as rolling Sharpe, monthly returns, and a comparison to the S&P500, giving you clear insights into how your investments are performing.

Conclusion: Take Control of Your Portfolio in 2025

Reducing drawdowns is crucial to building long-term wealth, especially in uncertain markets. By diversifying, using tactical and trend-following strategies, embracing risk management tools, and focusing on a balanced core-satellite approach, you can protect your portfolio from major downturns and enjoy more stable returns.

If you’re looking for a simpler way to manage your portfolio and reduce drawdowns in 2024, TheSimplePortfolio provides a ready-made solution. With a smart allocation strategy, a focus on risk-adjusted returns, and a high Sharpe ratio, it’s designed to keep your investments steady, even when the market gets choppy.

Sign up for TheSimplePortfolio and take control of your financial future with a portfolio strategy built to weather the ups and downs of the market. Whether you’re a finance enthusiast or a seasoned investor, TheSimplePortfolio offers the insights and allocations you need for a low-drawdown, high-confidence approach to investing.